- Get link

- Other Apps

The concept of cash laundering is essential to be understood for these working in the financial sector. It's a course of by which dirty cash is converted into clear cash. The sources of the cash in actual are prison and the money is invested in a approach that makes it appear like clean cash and hide the identification of the prison part of the money earned.

While executing the monetary transactions and establishing relationship with the new clients or maintaining present clients the duty of adopting adequate measures lie on each one who is part of the organization. The identification of such element at first is simple to deal with as a substitute realizing and encountering such conditions afterward in the transaction stage. The central financial institution in any country offers full guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to discourage such conditions.

Money laundering is designated as the source of illegally obtained funds covered through a series of transfers and deals in order that those same funds can eventually be made to appear as legitimate income Robinson. The concepts of Money Laundering explains.

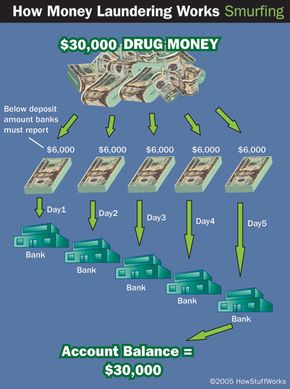

How Money Laundering Works Howstuffworks

Money laundering is the process by which large amount of illegally obtained money from drug trafficking terrorist activity or other serious crimes is given the appearance of having originated from the Legitimate source.

Explain money laundering concept. One of the theories brought by Mandinger and Zalopanyis that the history of. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. So Money Laundering is a way to hide the illegally acquired money.

It allows them to maintain control over the proceeds and provide a legitimate cover for their source of income. There are d i fferent understandings about the emergence of money laundering in the world. Concept of Money Laundering.

Money Laundering refers to converting illegally earned money into legitimate money. They want to use that money to buy themselves a nice house. The process of converting such proceeds of crime into legal and white money is known as money laundering.

And third making money. Because the moneys owner needs to create financial records ostensibly showing where the money came from the money must be Cleaned by running it through several legitimate. - first distancing funds from their source avoiding an association direct them with the crime.

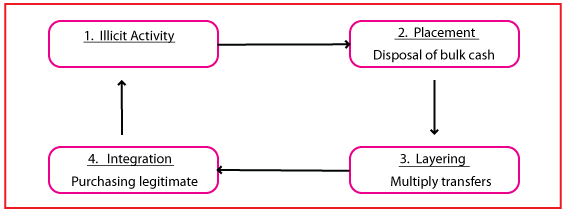

Money laundering has an adverse impact on economy and political stability of country and hence. The definition of money laundering according to HM Revenue and Customs is quite simple. To disguise illicit profits without compromising those involved money laundering takes place through a dynamic process that requires.

- second the disguise of its various movements to hinder the tracing of these resources. Money laundering is the process by which large amount of illegally obtained money from drug trafficking Terrorist activity or other serious crimes is given the appearance of having originated from the Legitimate source. Lets say a career criminal committed a couple crimes and is now in possession of a large heap of money in form of coins and paper currency.

The concept of the money-laundering phases assumes that. Money laundering is the illegal process of converting money earned from illegal activities into clean money that is money that can be freely used in legitimate business operations and does not have to be concealed from the authorities. Illegal money can also be referred as dirty money which can easily be clean by applying various tactics of money laundering.

Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. Explain the concept of Money Laundering and discuss its impact while throwing light upon legal framework in India. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today.

Discuss This is an all-encompassing directive you have to debate on paper by going through the details of the issues concerned by examining each one of them. Laundering physical money. But showing up with a huge bag of money at a bank or real estate agency would look very suspicious.

Yet the act in itself is much more complex. What is Money Laundering. But in simple terms it is the conversion of black money into white money.

Money laundering is the process by which large amount of illegally obtained money from drug trafficking terrorist activity or other serious crimes is given the appearance of having originated from the Legitimate source. Exchanging money or assets that were obtained criminally for money or other assets that are clean. You have to give reasons for both for and against.

Financial Action Task Force On Money Laundering Fatf Fincen Gov

What Is Money Laundering Definition Techniques Examples Video Lesson Transcript Study Com

Anti Money Laundering Overview Process And History

What Is Money Laundering And How Is It Done

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

What Is Money Laundering And How Is It Done

5 Types Of Money Laundering Explained In Detail

3 Stages Of Money Laundering Techniques Anti Money Laundering

How Money Laundering Works Howstuffworks

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Compliance Jobs

Money Laundering Meaning And Definition Tookitaki Tookitaki

Money Laundering And Its Prevention Money Laundering Concept Money Laundering Definition

The world of laws can seem like a bowl of alphabet soup at occasions. US cash laundering rules are not any exception. We have now compiled a list of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting agency centered on defending monetary services by lowering danger, fraud and losses. We now have huge bank experience in operational and regulatory threat. We've got a powerful background in program management, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many antagonistic consequences to the organization as a result of risks it presents. It will increase the probability of main risks and the chance value of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment