- Get link

- Other Apps

The concept of money laundering is essential to be understood for these working in the financial sector. It's a course of by which dirty cash is converted into clear money. The sources of the money in actual are legal and the cash is invested in a method that makes it seem like clean money and conceal the id of the prison part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the new prospects or maintaining present customers the obligation of adopting adequate measures lie on each one who is a part of the organization. The identification of such factor to start with is simple to deal with as a substitute realizing and encountering such situations in a while in the transaction stage. The central bank in any country supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

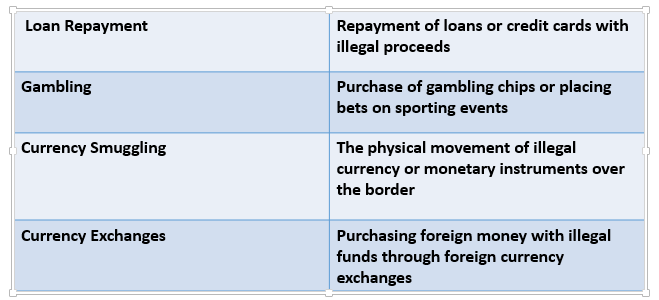

Some of the common methods include. The second involves carrying out complex financial transactions to camouflage the illegal source of the cash layering.

How To Prevent Illegal Money Laundering Activities In Bitcoin Exchange Business Money Laundering Anti Money Laundering Law Bitcoin

What is AML Anti-Money Laundering.

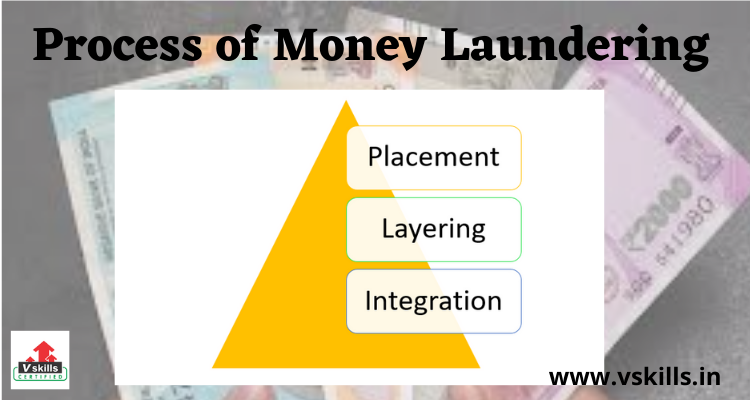

Placement aml meaning. Money laundering typically includes three stages. A Placement - the physical disposal of cash proceeds d erived from illegal activities. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc.

Know Your Customer KYC KYC is the process in which customers identity is verified against the identity proofs and documents submitted by them. The Placement Stage Filtering. The Placement Stage The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. AML screening is a part of KYC verification and is mandatory for several industries such as banks. B Layering - separating illicit proceeds from their source by.

The first involves introducing cash into the financial system by some means placement. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money. And at the same time hiding its source.

Placement is the point where illegal funds first enter the financial system. The money laundering process is divided into 3 segments. Banks and Financial Institutions conduct KYC process during the customer on-boarding process in order.

As illegal funds move from the placement stage through the integration stage they become increasingly harder to detect and trace back to the illegal source. Breaking down large sums of money into smaller amounts that can be deposited in banks without triggering AML reporting threshold alerts. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering.

Money laundering involves three steps. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Placement is one of the ways where illicit funds are separated from their illegal source and are placed into the financial system.

Generally this stage serves two purposes. The customer is screened against global watchlists sanctions and PEPs lists. Placement layering and integration.

Placement layering and integration stage. A it relieves the criminal of holding and guarding large amounts of bulky of cash. Depositing the ill gotten gains into financial institutions.

In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial. Anti-money laundering compliance is the process of background screening and ongoing monitoring of customers to identify and eliminate any efforts of money laundering. And finally acquiring wealth generated from the transactions of.

Structuring smurfing which the funds are of high value are broken into many small value transactions. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. Although you as a company stick to the rules this does not mean that your partners and business associates adhere to the same AML compliance laws as you.

Generally the money laundering process involves three 3 stages. Criminals may use several methodologies to place illegal money in the legitimate financial system including.

Process Of Money Laundering Placement Layering Integration

About Business Crime Solutions Money Laundering A Three Stage Process

What Is Money Laundering And How Is It Done

Process Of Money Laundering Placement Layering Integration

Why Are Kyc And Cdd Required Daily Ft

Money Laundering Video Presentation Youtube

Try To Be A Rainbow Art Print Quote Master Art Com Bright Quotes Art Prints Quotes Rainbow Quote

Without Struggle There Is No Progress Tattoos Ribcage Tattoo Meaningful Tattoos

Anti Money Laundering Overview Process And History

What Are The Three Stages Of Money Laundering

ومن آيات الحب يتمنى كل الجسد لو صار قلبا Kaligrafi

The world of laws can seem to be a bowl of alphabet soup at occasions. US money laundering laws aren't any exception. Now we have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Risk is consulting firm targeted on protecting monetary providers by decreasing threat, fraud and losses. We now have large bank expertise in operational and regulatory risk. We've got a strong background in program administration, regulatory and operational risk as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed penalties to the group as a result of dangers it presents. It increases the probability of major dangers and the chance cost of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment